A few weeks ago, I read a summary of the American Hardwood Export Council’s (AHEC) European conference, which, among other things, said that “one in every five boards of American lumber will now end up in China.”[i] The United States’ trading policies are on the minds of many in the wake of the US presidential election, so I wanted to dig a little further into some of the US export data[ii] on logs and lumber.

Log Exports

Most American log exports are conifer[iii] species (Figure 1). From 2005-2008, only 4% on average of total conifer log exports were destined for China. Since 2007, the share of conifer logs exported to China vs. other countries has increased. By 2011, 60% of US conifer logs were exported to China, more than all other countries combined, and this trend has persisted over the past six years.

While prior to 2011, logs exported to China were valued at $200/ton more than logs exported to other countries, the value of conifer log exports to China decreased significantly between 2006 and 2009 to be much more on par with conifer log exports to other countries. Since 2012, the value of conifer logs exported to other countries is approximately $25 USD/ton higher than the value of conifer logs exported to China.

Figure 1

Much fewer US hardwood logs are exported. For the most part, exports of hardwood[iv] logs to China have been increasing since 2005 (Figure 2). This growth has been most significant since 2013. On average, hardwood logs shipped to other countries are valued around $100 USD/ton more than those shipped to China. China and other countries purchase similar proportions of oak, beech and other nonconiferous species, which suggests that pricing differences are likely not due to differences in species but rather other factor(s), such as log quality.

Fgiure 2

Lumber Exports

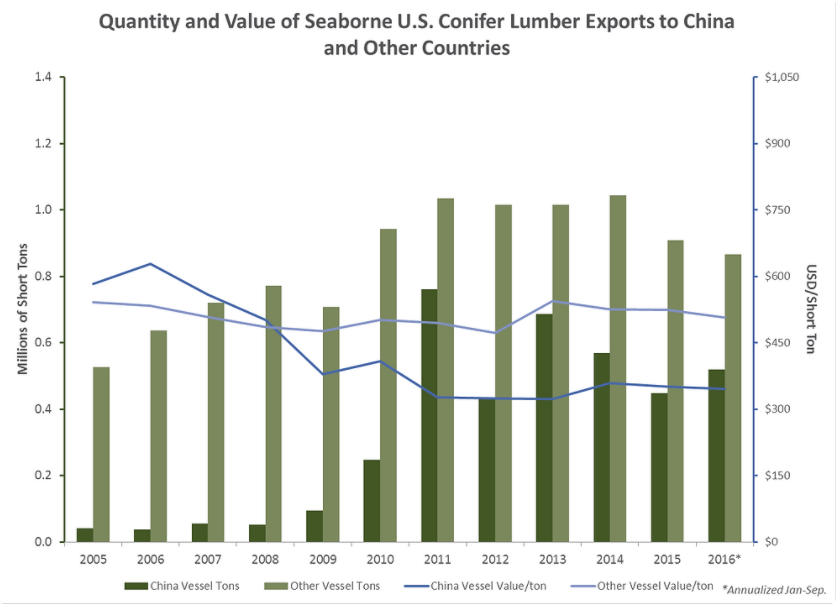

While conifer lumber[v] exports to China have been on a mostly declining trend since 2011, the average annual tonnage shipped during the 2011-2016 timeframe is still roughly double the exports from the previous 6-year period (Figure 3). But while volume has increased, the value of these shipments has plummeted from a high of approximately $628 USD/ton in 2006 to an average of $338/ton from 2011-2016.

Figure 3

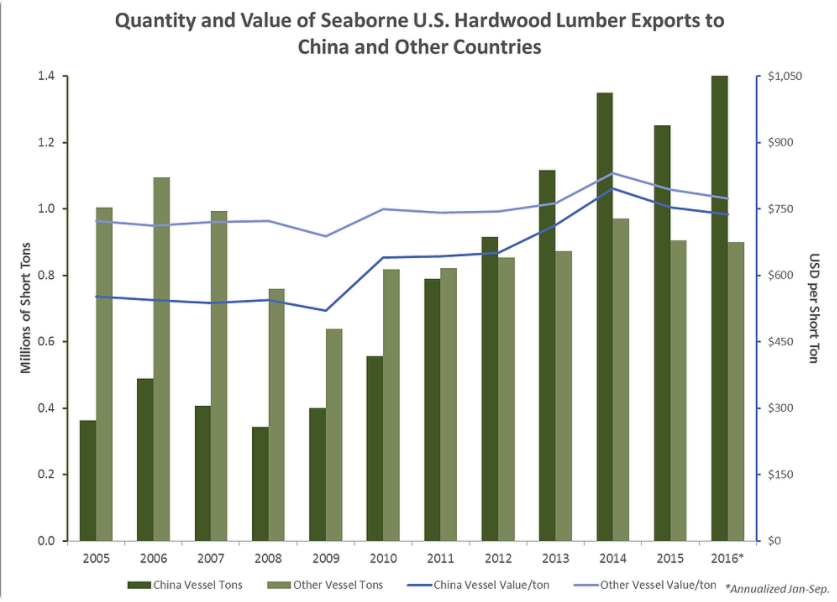

Conversely, hardwood lumber[vi] exports to China and values-per-ton have increased steadily since 2009 (Figure 4). While China has purchased more US hardwood lumber than all other countries combined since 2012, the value-per-ton remains lower than those values associated with shipments to other countries. Since 2013, US hardwood lumber averaged $750 USD/ton exported to China and $790 USD/ton to other countries. On average, China’s hardwood lumber purchases are comprised of higher proportions of maple, cherry, and ash and less oak than other countries.

Figure 4

Based on annualized data from January to September 2016, exports of conifer logs and lumber and hardwood logs and lumber will all increase from 2015 while exports of these commodities to other countries will decrease. China is on pace to import over 4.3 million tons of conifer logs from the US while exports to other countries will decline somewhat to 2.8 million tons (Figure 1). Annualized data suggest hardwood log exports to China will approach the 888,000 ton mark this year while hardwood log exports to other countries will fall to approximately 379,000 tons (Figure 2). YTD 2016 data suggest conifer lumber exports to China will increase to nearly 519,000 tons and exports to other countries will drop slightly to approximately 866,000 tons (Figure 3). Finally, hardwood lumber exports to China should increase to nearly 1.6 million tons while exports to other countries will decrease marginally to just over 900,000 tons. (Figure 4).

This high-level analysis of log and lumber exports certainly confirms that, by volume, China is the most important player for US log and lumber exports, and China’s share of US exports is increasing in 2016.

Recent Comments