In recent years, Russian birch plywood producers have faced a significant price increase in birch logs. This was partly driven by an increase in plywood production volumes by domestic producers, as well as rapidly increasing exports primarily sent to China. In addition, there are significant investments planned for birch plywood production in the coming years. If all announced investments are realized in the future, they will result in a nearly 1 million m3 annual increase in birch log consumption. In order to protect plywood producers and their competitive advantage in the global market, the Russian government may possibly introduce a temporary export ban for birch logs over 15 cm in diameter.

In October 2016, the Ministry of Industry and Trade of the Russian Federation initiated a temporary ban of birch log exports. A major step towards making this a reality was the approval of a recent government decree effective January 17, 2017, which stated that birch logs with the diameter larger than 15 cm are included in a list of high priority commodities for the Russian local market. The decree specifies that exports of these commodities may be temporarily limited or banned in extraordinary situations.

Birch Plywood Industry in Russia

Birch plywood production in Russia has demonstrated constant growth in recent years, producing nearly 3.5 million m3 in 2016. This industry is heavily export-oriented, with more than half of the volume being sold to lucrative markets in Europe, North America and the Middle East & North Africa (MENA). Total value of exported Russian birch plywood amounted to almost US $1 billion in 2016.

Traditionally, the producers have been concentrated in Western Russia, therefore competition for this raw material is rather high. Prices for birch veneer logs are steadily increasing. The actual price that mills are paying for high-quality birch veneer logs may also be considerably higher than the price noted on the official data. Due to raw material scarcity, some mills have secured a supply of veneer logs by reducing block diameter.

Russian Exports of Birch Logs

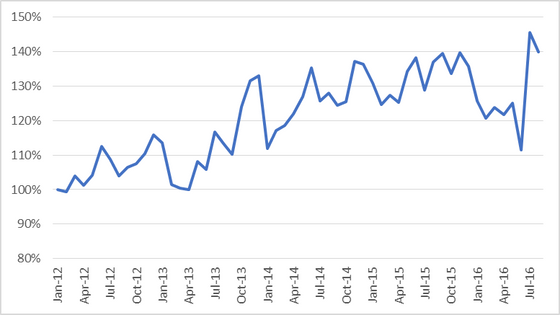

An increase in exports is being blamed for the increase in prices. Birch veneer log export volumes from Russia are estimated at 1.5-1.6 million m3 in 2016 vs. 1.3 million m3 in 2015. China is the leading importer, capturing 75 percent of total export volume in 2015 (and as high as 85 percent in 2016), followed by neighboring Finland. Other export destinations (in much smaller volumes) include Poland, Latvia and Belarus. Birch log exports to China increased rapidly from 2014-2016, however, annual growth slowed in 2016 to 25 percent.

Chinese Imports of Birch Logs from Russia, 2012-2016. Source: China Wood, Indufor

Russian Exports of Birch Logs, 2015 (Total: 1.3 million m3). Source: Russian Export Statistics

Increased Demand Fueled by New Investments

Export-oriented Russian plywood producers appear to be willing to invest in the expansion of manufacturing capacities to increase the production of value-added products. The most notable capacity expansions that have recently been announced include Segezha and Sveza Groups.

- Segezha’s Vyatka plywood mill will double its annual production capacity to 180,000 m3 by 2H2017, and the company plans to construct another greenfield mill in the Sokol, Vologda area.

- Sveza Group has announced that it will increase production volumes in its existing Kostroma and Uralskiy mills. In the future, both new mills and upgrades to existing mills are expected.

- In November 2016, Polish plywood manufacturer Paged Group announced plans to invest in a greenfield birch plywood mill in the Novgorod region. Planned production capacity will be 120,000 m3 If all of these investments are realized in the future, annual veneer log consumption will rise by almost 1 million m3.

Who Will Lose and Who Will Win?

Russian birch plywood producers will definitely “win” if an export ban takes effect. Birch veneer log prices will stabilize, and more high-quality logs will be available on the Russian market. In fact, the implementation of this ban would be very important in securing raw material for the upcoming investments. Conversely, the ban may negatively impact birch pulpwood prices for Russian pulp & paper (P&P) producers.

Outside of Russia, Finnish plywood producers will also lose some share of the raw material supply. Out of the three companies involved in plywood production, Koskisen would be affected the most, as they do not have any plywood manufacturing presence outside of Finland and are a small, family-owned company. However, a possible export ban will have an impact on birch pulpwood exports from Russia to Finland as well.

In 2016, nearly 4.5 million m3 of birch pulpwood was exported to Finland from Russia. The new regulation could lead to increased raw material expenses for Finnish P&P producers using birch pulpwood imports, as sorting would have to be done at the Russian border. The situation could create an opportunity for Baltic birch pulpwood suppliers to increase their exports to Finland, as a secure supply is of great importance to the Finnish industry.

In such a case, Chinese importers would also seek out new suppliers—primarily in the Baltics. This could be a double-edged sword for the Russian birch market, as the species is widely spread throughout Northern and Central Europe as well. Should a temporary ban take effect, Russia would see a significant drop in export volume and income from birch roundwood.

Russian Birch logs being trucked.

Recent Comments